Rental Market Trends Right Now (and What It Means for Owners)

The latest rental market data from Apartment List’s National Rent Report gives us a clear picture of how the market actually behaved as 2025 closed out, and it aligns closely with what we’re seeing locally with Pros PM.

Understanding rental market trends is about making informed decisions at the right time. Shifts in rent pricing, vacancy rates, and seasonal demand directly impact how quickly a property leases and how much income it generates. By staying informed on national and local trends, we can set reasonable goals and clear expectations. At Pros PM, tracking these trends enables us to move quickly, stay competitive, and protect our owners' long-term performance.

National Rental Market Trends

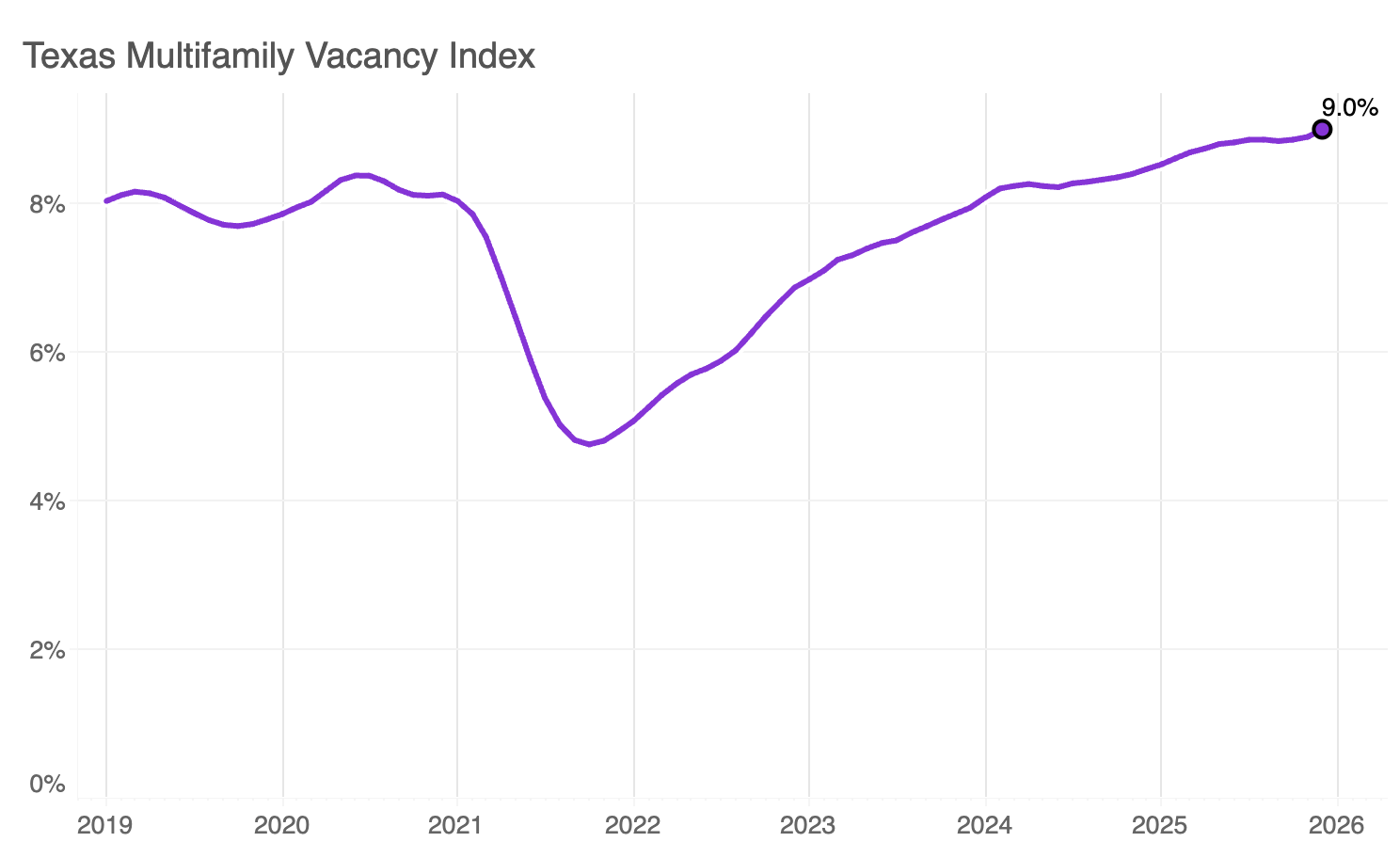

Nationally, the median rent price dipped 0.8% in December, marking five straight months of month-to-month rent declines. At the same time, the multifamily vacancy rate reached 7.3%, the highest level recorded by Apartment List since tracking began in 2017. Texas is seeing higher than the national average vacancy trends, as seen in the attached chart.

This trend reflects a broader shift toward a more balanced market, where seasonal cooldowns and elevated supply are easing upward pressure on rents after the rapid growth seen earlier in the decade. Prices have now declined year over year for more than 2 years and are nearly 6% below their 2022 peak.

Here at Pros PM, we’re seeing these trends play out on the ground:

We’re making more than 10 price adjustments per week to stay competitive with shifting market conditions.

Our average days on market is under 60 days, reflecting a slower leasing pace than during peak markets, yet stronger performance when pricing and marketing are optimized.

What This Means

This data underscores why dynamic pricing and responsive leasing strategies matter more than ever. In a market where demand changes seasonally, strategic adjustments help properties stand out, attract qualified residents, and minimize time on market.

Understanding national signals, such as rent softening and rising vacancy, helps us fine-tune pricing, optimize marketing investments, and prepare owners for a market that favors agility as we move into the spring leasing season.